Internalizing the Carbon Externality: Challenges in Solving the Market Failure

Franklin Roosevelt’s New Deal, enacted in response to the Great Depression, centered around relief for the unemployed, recovery from the nationwide financial meltdown, and reforming the financial system. Recently, there has been a lot of discussion about the Green New Deal in the media, a sort of new take on the nearly century-old reform. While not exactly a new idea, the proposed resolution aims to create jobs, improve infrastructure, and reduce carbon emissions, while also protecting vulnerable communities. In order to achieve the goals set forth by the plan, several auxiliary goals are needed. These goals focus mainly on (1) protecting (through training and liveable wages) communities that are at risk with the shift towards renewables, (2) preventing “leakage” of manufacturing and associated jobs overseas, and (3) providing governmental support, both legally and financially. This indeed is much like the namesake New Deal, but with a “green” bent.

While the resolution remains a draft and is quite vague, it would be nonbinding and unlikely to pass. However, it does get people talking about what is possible and what our goals should be as a society looking towards the future. While the Green New Deal takes a similar approach as the Renewable Portfolio Standard, by proposing regulation as a way of shifting our economy towards renewables, is it the ideal method for creating the major change that is needed to decarbonize the US?

Externalities and carbon taxation

Economics says no. Reliance on non-renewable energy throughout our economy generates considerable negative impacts for society. A car burning gasoline and a power plant burning coal or natural gas both generate emissions that contribute to climate change, which has the potential to impact all life on earth. These impacts, called externalities, are felt (and paid for) by those beyond the individuals consuming the product. Not pricing carbon externalities is considered a market failure. The car burning gasoline generates CO2, which contributes to the changing climate that creates droughts in California or melts ice in the Arctic. In all but a few states, neither the gasoline producer nor the consumer is paying for a portion of the damages done by the resulting wildfires or rising sea levels. Carbon taxes attempt to put a price on those damages in order to close the loop. A huge challenge, then, is agreeing on what that price should be, to accurately reflect the social cost brought on by the emissions.

But how does taxing carbon really accomplish anything? We can assume that energy demand is inelastic: That as the price of energy changes, our consumption will change little or not at all. By contrast, an elastic product would be considered relatively frivolous, such as televisions. If the price of televisions were to rise substantially, demand would likely fall - you might choose to hold off on replacing your current device. If the price of electricity goes up, we will continue to turn on the lights and use the heat or air conditioner.

Because we are assuming that energy consumption is inelastic, we can also assume that any carbon tax assessed on a producer would be passed through 100% to the consumer. Some consumers may adjust their consumption depending on how price sensitive they are, however many may not. When it comes time for the power provider to evaluate its portfolio and the firm sees that a coal plant is reaching the end of its useful life, the firm may decide to invest in renewables generation rather than a new carbon-fueled plant. Under this carbon pricing scenario, a renewable project developer may be able to offer a price that is more competitive with conventional generation. The decision to “go green” would reduce the firm’s total carbon cost, allowing the producer more flexibility in choosing the new plant technology. This may also allow the firm to continue to charge the same or similar electric rates to customers, capturing the additional margin. Thus a carbon tax incentivizes power producers to invest in carbon-free energy sources.

Still assuming that a carbon tax is passed through to customers, one of the biggest challenges is that low income individuals spend a higher proportion of their earnings on energy than higher income individuals. The onus placed on those already living paycheck-to-paycheck is substantial, but solutions have been proposed to address it. The option with the most momentum is a carbon fee and dividend plan, called the Energy Innovation and Carbon Dividend Act, where each individual paying into the carbon tax (called a “fee” here because it is revenue-neutral) would receive a refund check each month. Those funds would be the same for each individual, thus the revenue from fees for heating a 8,000 square foot home may flow towards those paying to heat a 300 square foot apartment. Such a revenue-neutral plan is net positive for low income individuals, with the goal of providing the price signal for heavy energy users to reduce their consumption and for driving producer investment in carbon-free generation.

Carbon tax alternatives

For several reasons, many view carbon taxes as politically unattractive, which has led to an alternative proposition: A scheme commonly known as “cap and trade.” Under these programs, which do not require legislation to implement, a governing body creates a market and allocates polluters a certain amount they are allowed to pollute. Those allocations may stay constant or fall over time. Businesses that do not need all of their credits can sell them into a market to those businesses who have not made the efficiency improvements or are unwilling to make changes, and thus need more than their allocated credits. This can drive innovation, pushing the technology frontier forward.

Economists, however, argue that a carbon fee and dividend program is the most efficient way to solve the existing market failure. We should be listening to these experts. Alas, because businesses have great power in our political system, implementation of a meaningful carbon tax in any form will be extremely difficult. Even experts have difficulty in reaching a consensus on the level of such a tax, let alone how it should be applied (i.e. should the tax be levied on the consumer or the producer?). This is one more reason why cap and trade systems have been the only successful mechanism in the US, and the most widely implemented globally.

Carbon management globally

The World Bank maintains a user friendly and informative interface that allows us to explore the implemented and proposed carbon accounting programs worldwide. According to this data, 4.3% of global greenhouse gas (GHG) emissions are covered by implemented carbon tax programs, with another 0.9% scheduled to be rolled out in 2019. Implemented emissions trading systems (ETS, equivalent to cap-and-trade) account for 9.5% of global emissions, and scheduled programs will cover an additional 5.9%. Assuming everything continues as planned, 20.6% of global emissions (on 2018 basis) will be accounted for by ETS and carbon taxes by the end of 2019.

Three programs have been implemented in the US, which, combined, represent 0.3% of global GHG emissions. In contrast, the ETS program in the EU represents 3.9% of global GHGs, and ETS programs in China represent 5.1% of global GHGs. The US has a long way to go to catch up with other countries.

What might a carbon fee look like for the average consumer?

The US Energy Information Administration (EIA) is a wealth of information on all things energy. Energy producers are required to periodically provide data to the group, which aggregates it and makes it available to the public. The EIA was the source for much of the information in this analysis.

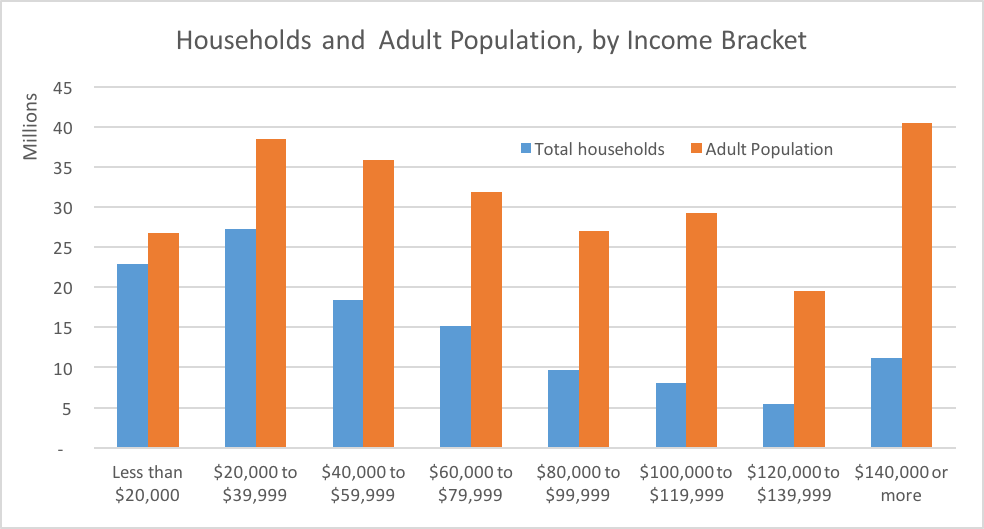

I was interested in understanding what a carbon fee-and-dividend program might look like across different income brackets, so this is where I got started. While most proposals for such programs involve assessing fees on the electricity producers, I have assumed here that producers would systematically shift those costs onto consumers. I have also chosen $25/ton and $50/ton carbon prices to provide a range of results. (To understand the scale of a ton of carbon dioxide, a car travelling 10,000 miles annually with an average fuel economy of 30 mpg would emit 3.3 tons of CO2 per year.) The EIA periodically performs a Residential Energy Consumption Survey, with the most recent occurring in 2015. I used this site as well as the US census as the major sources of data for this analysis. Based on the census data, here is how the income buckets shake out.

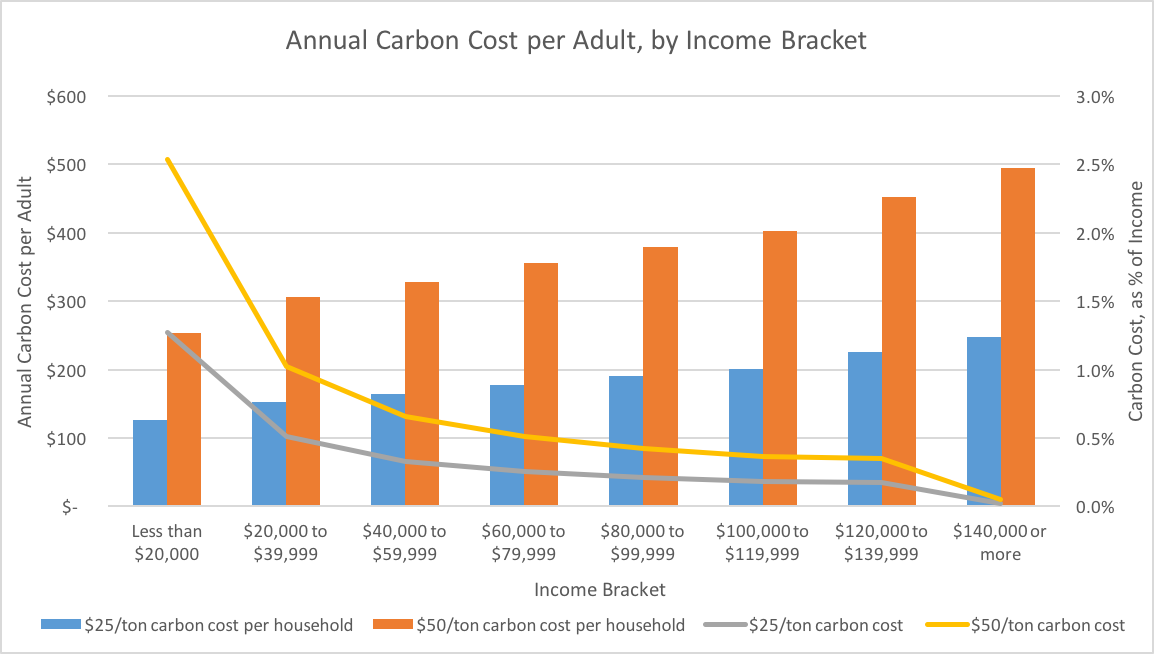

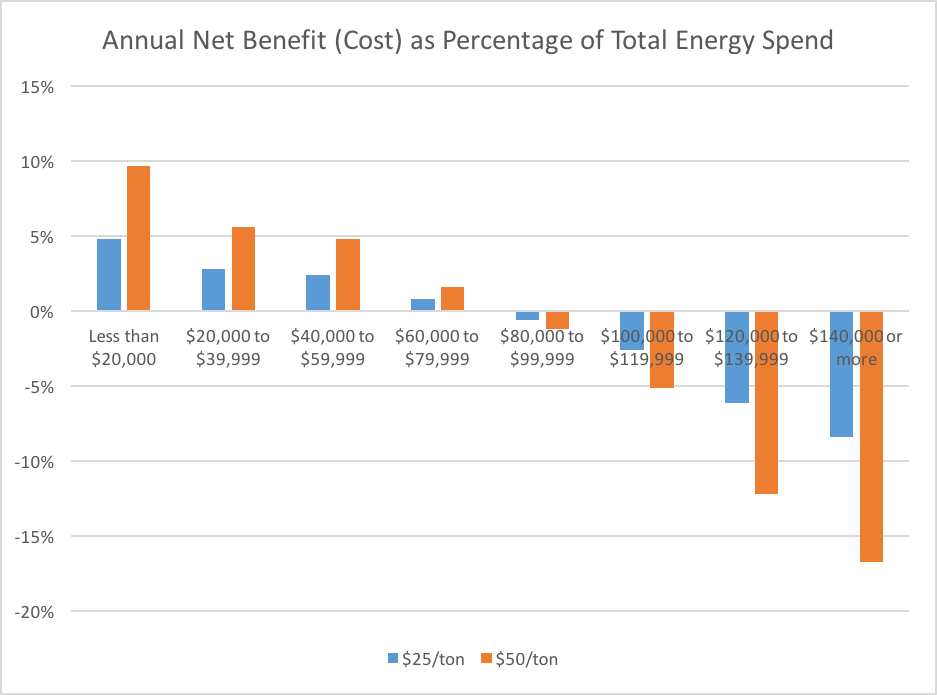

Because the impacts of a carbon fee on low-income households could be substantial, it is important to look not only at the net benefit or cost of the program for individuals, but also the up-front cost to energy users. Under a the fee-and-dividend scheme, monthly energy bills would rise, with the dividend for being paid out monthly. How much capital, then, would a low income individual have to front before receiving benefits via fee refunds? If we calculate what the annual cost of the carbon generated by electricity is for adults (anyone over the age of 18) in each income bracket, the result is the chart below.

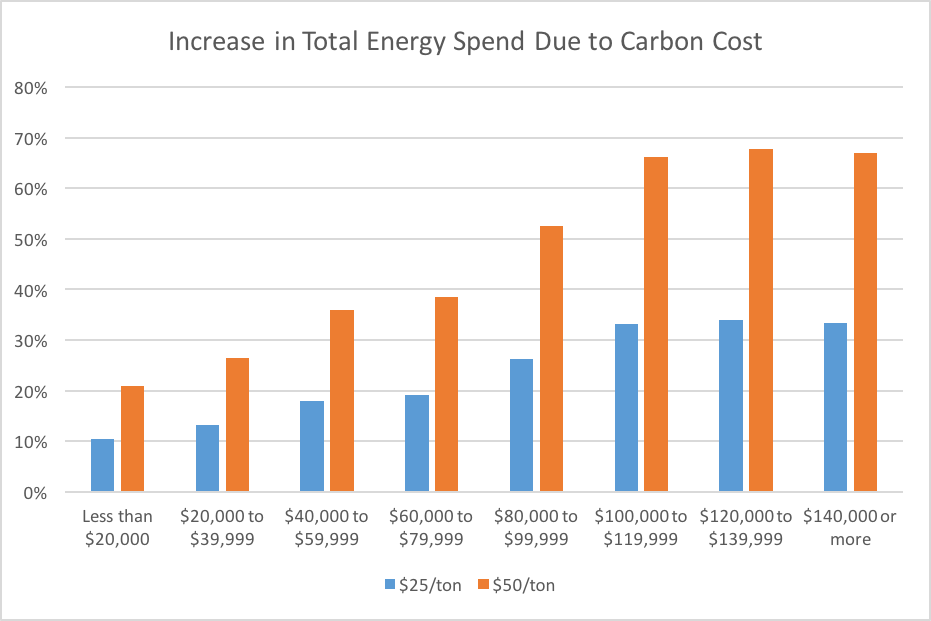

As expected, the cost as a fraction of the household income is very high (1.3% and 2.5% under the $25 and $50/ton scenarios, respectively) for the lowest income brackets, and it falls off as incomes rise. If we also look at what that added cost translates to in terms of increases in total annual energy bills, we see that even for the lowest income bucket, the increase in energy cost is substantial.

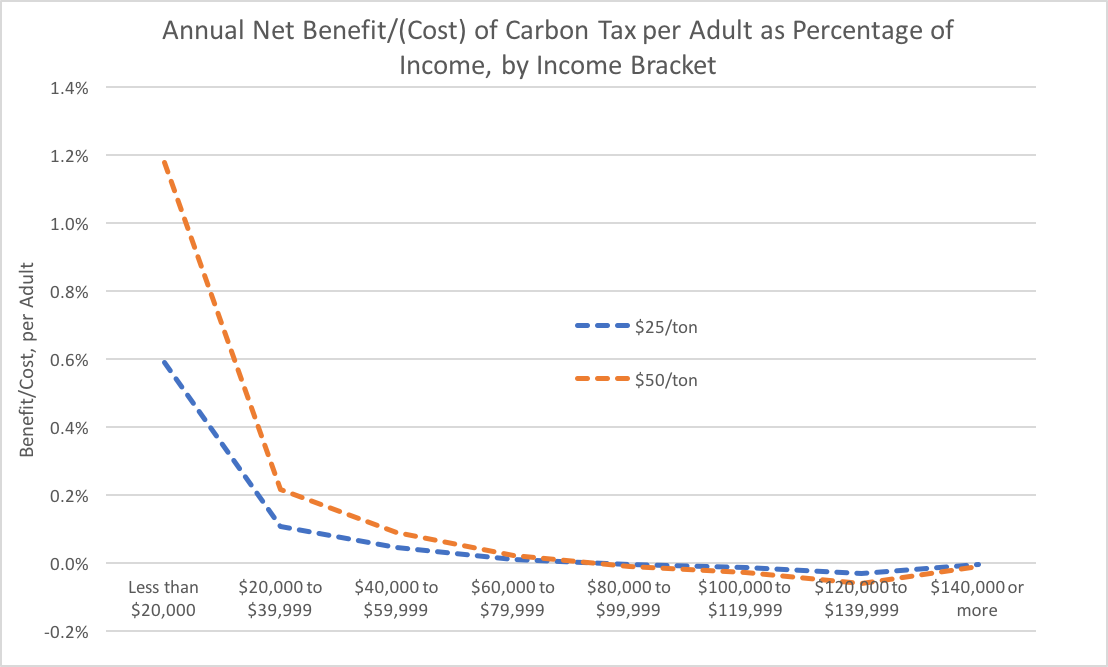

If we assume all paid fees are placed into a pool of funds, which are then distributed evenly to each adult, those in the lowest income brackets do see a net positive impact. For example, under the $50/ton carbon fee scenario, an adult in the $20,000 to $39,999 income range would pay $306 per year on average in additional fees to their electricity provider. Over the course of a year, that individual would receive a total refund of $371. The net benefit of $65 represents 0.2% on an income of $29,500 (assuming the income bracket is evenly distributed). The net benefit in this case is small, while the burden of the higher electricity costs over the course of the year may be substantial.

In contrast, those households earning $60,000 and up see very little in net benefit or cost when compared to their overall income. Those in the highest bracket see almost the exact opposite flow of funds of those in the lowest bracket, however the added cost of the fee represents a miniscule percentage of household income to those in the highest bracket.

Evaluating the cost or benefit as a percentage of the total energy costs per person is also a helpful metric. Low income individuals, under the $50/ton scenario, could see the benefit they receive represent as much as 10% of their energy bill, and the highest income individuals could see a net cost of an additional 17%.

To summarize the results of all of this:

- Individuals in the lower income brackets end up with a net benefit, however they would be required to front cash that they may be unable to afford. The added cost could be as high as 20% over their current energy bills.

- Middle and higher income individuals end up with a net cost, where their energy bills would be higher than the pre-carbon-fee bills and the dividend they would receive would not cover the increase in cost. The amount of this cost is so small that it represents nearly 0% of annual income, but could represent an increase in energy bills by as much as 67%.

Because of the high increase in energy cost, it is conceivable that individuals who are energy and cost conscious may adjust their behavior based on the price signal. Similarly, because lower income brackets spend a large proportion of their income on energy, an increase in energy cost may drive reduced consumption, regardless of the existence of the dividend. Adults would receive the dividend each month, while they would also continue to pay their energy bills monthly. Perhaps this design, where the receipt of the dividend is disconnected from the energy payments, would help drive household efficiency improvements.

The challenges of implementing a carbon fee-and-dividend program could also prove costly and inaccurate. The fewer tax entities involved, the easier it is to implement a program, which is one reason why carbon taxes without dividends applied to producers are much easier to manage. Easier still are carbon emissions trading schemes, because they do not require the legislation that carbon taxes do. But how does a carbon trading program work and how is it different from a carbon tax?

Carbon emissions trading programs in practice

I recently attended a discussion by Dallas Burtraw entitled Robust Carbon Markets: Rethinking Quantities and Prices at the Kleinman Center for Energy Policy at the University of Pennsylvania. Much of the talk centered on historical observations in emissions trading systems, and how to address some of the shortcomings. In the US, emissions trading markets often observe price spikes, followed by price declines that persist. This phenomenon can arise from overallocation, companion policies (both complementary and undermining), tax credits, and others.

On the east coast, an intergovernmental organization established in 2009 created a nine-state cap and trade system called the Regional Greenhouse Gas Initiative (RGGI) that applies to the power generation market. The program acts much like the typical cap-and-trade system, but with a few key differences:

- It creates an adaptive price cap, while also reducing the number of allowances available annually

- It institutes a price floor beginning in 2021, by withholding emissions allowances

Burtraw views carbon management programs as non-cooperative games, where no one is pricing carbon correctly, and thus movements in emissions are slow. By introducing both a floor and a cap, the RGGI creates a model that maintains relative stability. States then use the revenues generated from the system to reinvest in programs to further reduce carbon emissions, such as energy efficiency and renewable energy projects. Auction prices in 2018 were around $4-5/short ton.

But what do the numbers really look like for an individual under a system like this? With auction prices at such low values ($4-5/ton) and considering the analysis laid out earlier where carbon prices were as much as ten times higher ($25-50/ton), it seems unlikely that a carbon trading system would trickle down and generate the price signals to consumers that would drive reduced consumption or to producers to drive innovation. Such low carbon prices spread out over so many consumers seems as though it would increase bills by so little (again, assuming that the producers pass through all of the cost to consumers) that consumers may not even notice.

Alternative options - How to maximize impact

In considering ways to mitigate some of the challenges posed throughout this discussion, a few thoughts come to mind:

- Phase-in the carbon fee over time

- Create a tiered carbon taxation method

- Improve mechanisms for customers to observe (and alter) real-time usage

One way to mitigate the impact of the high up-front costs for lower income individuals is phase-in the fee, first to those of higher incomes, and last to those of lower incomes. The revenue generated by the carbon fees paid by higher income individuals could then be provided to the lower income individuals to cushion the blow of higher energy prices going forward. While the idea makes sense in theory, it would be very hard to implement in practice, given that these carbon fees would probably be applied to a utility bill, likely based on kWh of usage. It would be difficult to tie that back to income reported to the IRS, making it difficult to identify which individuals should pay the fee upon roll-out and which should not. It is worth mentioning that low income individuals currently have the ability to work with utility providers to receive subsidized energy rates. Either using the existing customer list or having individuals apply are ways to solve this when it comes to a carbon fee as well, however it is a significant friction and may not be straightforward to all.

A tiered taxation scheme, similar to that used for income taxes, could also mimic desired results amongst varying income groups. Lowest income customers could pay no tax, while the highest income customers would pay a higher carbon tax rate. Utilities already implement lower energy rates for low income individuals, so this option may not be terribly difficult to implement. Taking this one step further, the lowest income individuals could be provided with incentives to reduce consumption (rather than increased prices for all their energy), providing consumers the opportunity to receive bill credits for reducing consumption over time. Utilities could also gamify such a program. This is similar to what utilities have already rolled out in some areas, providing neighborhood consumption data on individual bills, pitting neighbor against neighbor in the race to lower energy costs.

One of the biggest challenges that arises from price signals on energy use is that we do not immediately see the dollars racking up as we increase our consumption: There is a disconnect between our consumption and the bill we receive. We may see a higher bill than we are used to one month, but we may not know exactly what caused it. If we had a simple way of watching the costs accumulate in real time, we might be more thoughtful of our actions, and grab a sweater instead of turning the thermostat up another three degrees.

Smart meters installed by some utilities allow residents to monitor their energy consumption on a much more granular level. Utilities often employ apps that allow users to see hourly consumption, and, in some cases, provide hardware to allow users to monitor usage in real time. DTE in Michigan rolled out an optional program that did just that in 2017. As an early adopter, my household quite enjoyed monitoring, and adjusting, our behavior on this level. Being able to look back on a day and observe the impacts of behavior can be hugely valuable to reducing our consumption, or simply to understand what our choices mean for our energy bills.

It is interesting to step back for a moment and consider the large technology firms that have committed to 100% renewable energy. Firms like Apple and Alphabet derive nearly all of their value from electric power: The apps on your phone, the use of your computer, and the ability to search Google all arise from the flow of electrons. These firms have chosen to enter into (likely long-term) agreements with carbon-free energy providers, limiting the exposure of the firms to fluctuations in energy prices brought on by things like carbon taxes or emissions trading. One could argue that the likes of Apple and Alphabet have “gone green” for the marketing aspect of it, but there is likely some risk mitigation involved as well.

Conclusion

All of this discussion has outlined just how difficult it is to create the perfect carbon management program. Putting a price on externalities would increase the price of energy, and it must be high enough to reduce overall demand and drive innovation and shifts towards carbon-free energy. Those price increases must also not be so high as to put undue burden on low income individuals. Individuals of higher income that do have the means to reduce consumption with little noticeable impact on daily life are those that should begin shifting their consumption. However, those are also the individuals who may not notice any increases in energy costs (or may simply be willing to pay the additional price for the same level of comfort).

Three main concerns arise from the overall discussion:

- Ideas and programs created based on theory may not pan out in reality. Implementing a program may be costly, error-prone, difficult to institute properly, or politically impossible

- Low income individuals must be protected from substantial financial impacts of a carbon management system

- Carbon pricing must accurately reflect the externalities, while also providing a sufficient price signal to shift demand or drive investment in alternatives

Economic theory suggests that the most efficient option for managing the carbon externality is a carbon tax. However, implementing such a theory gets complicated quickly, as regions must decide how to determine the appropriate tax level, protect vulnerable populations, and invent a program that meshes with current policy, regulations, and energy provider operations. Ultimately, educating consumers on current consumption could provide a means to reduce energy use without the need for policy. While studies have shown varying efficiency improvements, one group of researchers observed 5% energy reduction for a large sample of users in Austria. While a 5% reduction in energy usage is smaller than what a carbon fee might drive if it were to increase energy bills by 10-60%, real-time data could be a first step in providing consumers with the information needed to see dollars flowing out of their bank accounts, and to demand more innovative alternatives.